Understanding Construction Industry Scheme Payments

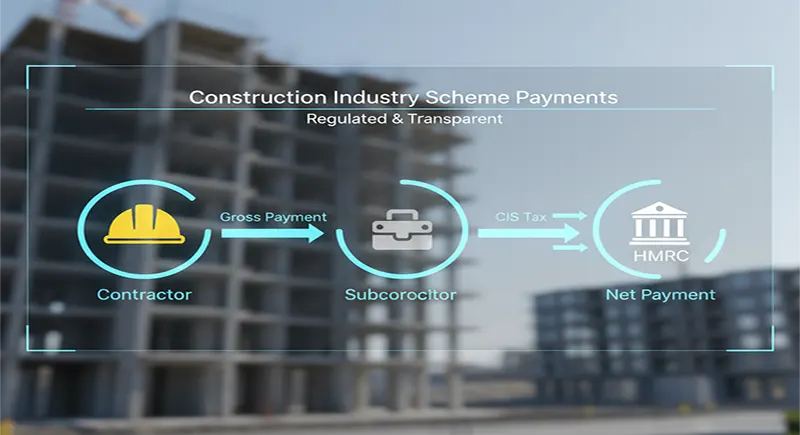

The Construction Industry Scheme (CIS) is a UK government programme that regulates payments made by contractors to subcontractors in the construction industry. Under this scheme, contractors must deduct a percentage of the payment due to a subcontractor and pass it to HM Revenue & Customs (HMRC). These deductions are essentially tax payments in advance, which are then offset against the subcontractor’s overall tax liability at the end of the fiscal year. The purpose is to ensure proper tax collection from individuals and small businesses operating in construction and related trades.

CIS deductions vary depending on whether a subcontractor is registered with HMRC and meets certain verification criteria. If fully verified, a subcontractor typically faces a 20 % standard deduction; if not, a higher rate of 30 % may apply. In practice, these deductions can significantly affect cash flow and profitability, especially for small firms with tight margins.