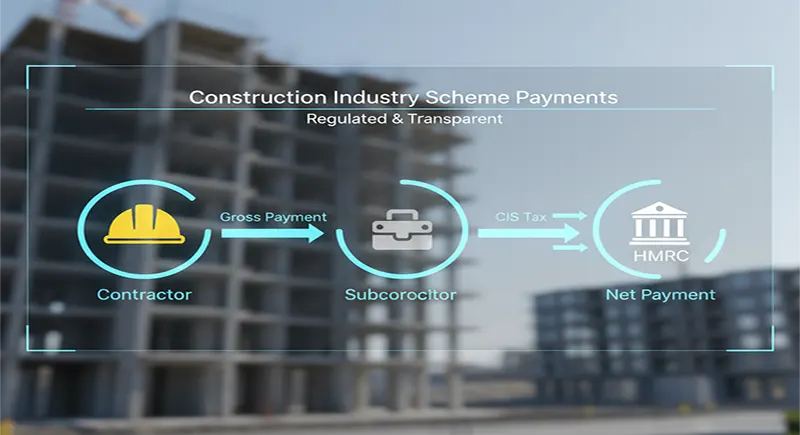

The Construction Industry Scheme (CIS) is a UK government programme that regulates payments made by contractors to subcontractors in the construction industry. Under this scheme, contractors must deduct a percentage of the payment due to a subcontractor and pass it to HM Revenue & Customs (HMRC). These deductions are essentially tax payments in advance, which are then offset against the subcontractor’s overall tax liability at the end of the fiscal year. The purpose is to ensure proper tax collection from individuals and small businesses operating in construction and related trades.

CIS deductions vary depending on whether a subcontractor is registered with HMRC and meets certain verification criteria. If fully verified, a subcontractor typically faces a 20 % standard deduction; if not, a higher rate of 30 % may apply. In practice, these deductions can significantly affect cash flow and profitability, especially for small firms with tight margins.

Why Understanding CIS Deductions Matters

Accurately managing CIS deductions is crucial for subcontractors. If deductions are not correctly recorded or claimed, a subcontractor might overpay taxes or forfeit funds owed to them. It is not unusual for subcontractors to be unaware of their entitlement to claim excess deductions or to miss important deadlines.

Recording every CIS deduction on invoices—or via a CIS statement issued by the contractor—is vital. These recorded amounts then form part of the subcontractor’s tax return, allowing them to reclaim overpaid amounts or apply the deductions to their tax bill.

Reclaiming Overpaid CIS Deductions

When the tax year ends, a subcontractor submits a self-assessment tax return to HMRC, itemising income, allowances and all CIS deductions. If the total deductions exceed the amount of tax the subcontractor owes, a refund may be due. This process essentially functions as a rebate mechanism, returning the overpaid amount to the taxpayer.

It is also possible, in certain circumstances, to carry forward unused deductions against future tax liabilities. The precise scenario depends on the taxpayer’s overall income, reliefs and tax bands. HMRC’s guidelines explain the eligibility and mechanics of such claims.

Common Pitfalls and How to Avoid Them

One common issue is neglecting to include smaller deductions or accidentally omitting them from the self-assessment. Another problem lies in misunderstanding allowable expenses and their interaction with CIS deductions. Only legitimate business expenses should reduce taxable profits; mixing personal expenditure can provoke HMRC enquiries.

Subcontractors should maintain clear, chronological records, including retentions, final certificates, and adjustments. Seeking professional advice can minimise errors. Moreover, deadlines matter: late filing or errors can result in penalties or delayed refunds.

The Role of Professional Advice and Compliance

Many smaller firms engage accountants or tax advisors to ensure compliance. Professionals can help verify subcontractor status, manage deductions throughout the year, and ensure that any overpayment is reclaimed promptly. This is especially helpful when working across multiple contracts, rates, or jurisdictions, or when circumstances change (for instance, if a subcontractor becomes incorporated).

Staying up to date with legislative changes is also essential. Changes to rates, thresholds or reporting requirements can affect the way deductions and refunds should be handled.

How CIS Tax Rebates Help Subcontractors

A rebate under CIS allows subcontractors to recover money they have overpaid through deductions during the year. The process essentially ensures they are not penalised for excessive withholding, and restores fairness to their tax burden. When completed correctly, a CIS Tax Rebates claim may result in a significant refund that improves cash flow and supports business stability.

To initiate such a claim, the subcontractor includes the deductions in their self-assessment and provides the required supporting documentation: CIS statements, invoices, and proof of allowable costs. The repayment is then processed by HMRC and issued, often via direct deposit or cheque.

Many subcontractors are unaware of the full potential of CIS Tax Rebates, so raising awareness is vital. Consulting a specialist tax advisor or accountant can help identify overlooked opportunities and ensure the claim is optimised. By doing so, contractors can better manage their finances, reduce wasteful overpayments and build confidence in their tax position.