Best Modem Router Combo for Xfinity: A Comprehensive Guide

In today’s digitally connected world, having a reliable modem router combo is essential for smooth internet connectivity. For Xfinity users, selecting the best modem router combo is crucial to ensure optimal performance and compatibility with their internet service. With numerous options available in the market, finding the perfect modem router combo can be overwhelming. This comprehensive guide aims to simplify the selection process by highlighting the top modem router combos for Xfinity, considering factors such as performance, features, compatibility, and value for money.

Understanding Xfinity Internet Service

Before delving into the best modem router combos for Xfinity, it’s essential to understand the specifics of Xfinity internet service. Xfinity, offered by Comcast, is one of the largest internet service providers in the United States, serving millions of customers nationwide. Xfinity offers a range of internet plans, including cable, fiber, and hybrid-fiber coaxial (HFC) technologies, with varying speeds to cater to different user requirements.

Factors to Consider When Choosing a Modem Router Combo

Selecting the right modem router combo for Xfinity involves considering several key factors to ensure optimal performance and compatibility:

1. Compatibility:

Ensure that the modem router combo is compatible with Xfinity internet service. Compatibility involves both hardware and firmware compatibility with Xfinity’s network infrastructure and service specifications.

2. Performance:

Look for a modem router combo that delivers high-speed performance suitable for your internet plan. Consider factors such as download/upload speeds, channel bonding capabilities, and Wi-Fi standards (e.g., 802.11ac, 802.11ax).

3. Coverage and Range:

Evaluate the coverage and range offered by the modem router combo’s Wi-Fi capabilities. Opt for models with advanced antenna technology and beamforming features for extended coverage and better signal strength throughout your home or office.

4. Security Features:

Prioritize modem router combos with robust security features, including built-in firewalls, WPA/WPA2 encryption, and guest network isolation, to … Continue reading >>>

Unveiling the Future: Blockchain’s Role in the Casino Industry

In the fast-paced world of online gambling, blockchain technology is emerging as a game-changer, promising to revolutionize the way casinos operate and players engage. In its essence, blockchain functions as a distributed ledger system that logs transactions across multiple computers, guaranteeing transparency, security, and permanence.

In the casino industry, this technology holds immense potential to address longstanding challenges and transform the gaming experience for both players and operators.

Blockchain-Powered Payment Solutions

One of the most significant applications of blockchain in the casino industry is its use in payment solutions. Traditional payment methods often come with high fees, lengthy processing times, and concerns about security and privacy. Blockchain-based payment systems, on the other hand, offer a solution to these issues. Cryptocurrencies, such as Bitcoin and Ethereum, enable instant and low-cost transactions, providing players with a seamless and efficient way to deposit and withdraw funds from their casino accounts. Additionally, blockchain technology ensures the integrity and transparency of transactions, reducing the risk of fraud and ensuring fair play.

Ensuring Fairness and Transparency

Transparency and fairness are paramount in the world of gambling. Players want to know that the games they’re playing are fair and that the outcomes haven’t been tampered with. Blockchain technology offers a solution to this problem through the concept of provably fair gaming. By leveraging cryptographic algorithms and smart contracts, blockchain-powered casinos can provide verifiable proof that game outcomes are truly random and not influenced by external factors. This transparency not only enhances player trust but also fosters a more level playing field for all participants.

Enhancing Player Trust and Confidence

Trust is the foundation of any successful casino operation. With blockchain technology, casinos can build trust and confidence among players by providing transparent and immutable records of gaming transactions and outcomes. Every transaction conducted on a blockchain is … Continue reading >>>

DAV2 Certification Demystified: Your Complete Study Companion

In the ever-evolving landscape of data analysis and interpretation, the DAV2 certification exam stands as a beacon of excellence, a testament to your mastery of advanced data analytics. Imagine wielding the power to unlock the secrets hidden within vast datasets, predict future trends, and influence critical decision-making processes.

That’s precisely what the DAV2 exam questions dumps promises: an opportunity to become a trusted data analysis expert. In this comprehensive exam guide, we embark on a journey to equip you with the knowledge and skills needed to conquer the DAV2 certification.

Data Analysis Fundamentals

Key Concepts and Terminology

In this domain, you’ll delve into the foundational language of data analysis. You’ll learn to decipher the cryptic world of data jargon, making concepts like variance, correlation, and outliers your trusted companions in the data-driven journey.

Data Sources and Collection

Data is the lifeblood of analytics, and here, you’ll explore the arteries that feed it. From databases to APIs, you’ll discover how to harness data from various sources and assemble it for meaningful analysis.

Data Cleaning and Preprocessing

They say cleanliness is next to godliness, and in data analysis, it’s no different. Discover how to scrub and polish your raw data, ensuring it’s pristine and ready for insights.

Exploratory Data Analysis

EDA is where the magic begins. Dive deep into this enchanting world where you’ll uncover hidden patterns, anomalies, and stories within the data, setting the stage for your analytical adventure.

Statistical Analysis Basics

The language of statistics is the gateway to understanding uncertainty and making informed decisions. Here, you’ll gain fluency in statistical concepts, from probability to hypothesis testing, that will empower you in your data analysis pursuits.

Advanced-Data Analysis Techniques

Hypothesis Testing

Welcome to the courtroom of data analysis, where you’ll play the role of both prosecutor and defense. Learn how … Continue reading >>>

RankLike SEO: Elevating Your Website’s Visibility

In the ever-evolving digital landscape, search engine optimization (SEO) has become an indispensable tool for businesses and website owners. RankLike SEO, a cutting-edge approach to search engine optimization, stands out as an innovative and effective way to improve your website’s visibility and search engine rankings. In this article, we delve into the key concepts and benefits of RankLike SEO, helping you understand how it can transform your online presence.

What is RankLike SEO?

RankLike SEO is a modern SEO strategy that focuses on providing not just better rankings on search engines but also a superior user experience. It embraces the idea that SEO should go beyond simply appeasing search engine algorithms, and instead, it should prioritize delivering valuable, engaging content to users. This approach involves a multi-faceted strategy that encompasses several essential components.

The Pillars of RankLike SEO

- User-Centric Content: RankLike SEO places a strong emphasis on creating high-quality, user-centric content. This means understanding your audience’s needs, crafting content that answers their questions, and engaging users with informative, valuable information.

- Technical Excellence: A well-optimized website is crucial for SEO success. RankLike SEO pays attention to technical aspects like website speed, mobile responsiveness, structured data, and more to ensure that your website is user-friendly and search engine-friendly.

- Quality Backlinks: Building quality backlinks remains a fundamental component of RankLike SEO. However, the emphasis is on cultivating natural, organic link profiles that stem from authoritative and reputable sources. It discourages black-hat link-building practices.

- Analytics and Iteration: RankLike SEO incorporates robust analytics tools to monitor and measure performance continuously. It uses data-driven insights to make informed adjustments to the strategy, ensuring your website’s continuous improvement.

Benefits of RankLike SEO

- Sustainable Rankings: Unlike some short-term SEO tactics, RankLike SEO focuses on sustainable, long-term results. By focusing on user experience

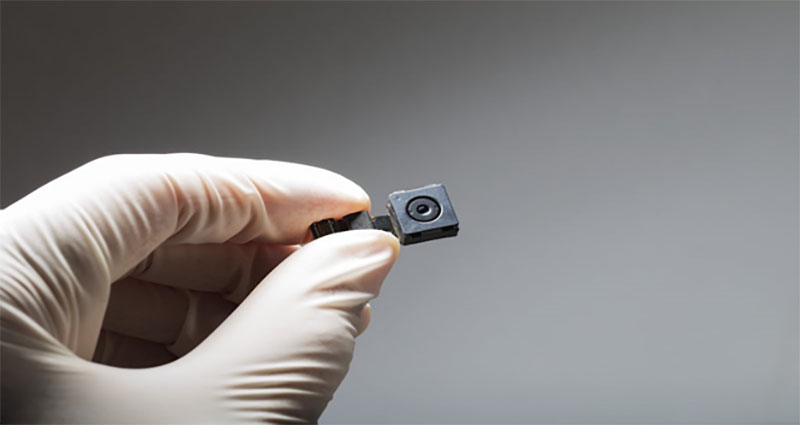

The Truth about Secret Surveillance and Reasons for Installing Them

You have surely seen surveillance cameras in public places, and they’re scattered to monitor the situation. Though some of these devices may have been installed in hidden spots so you’re not aware of them. There are even houses installed with CCTVs and hidden cams for added protection.

Anyway, installing secret surveillance cameras can be taken positively for some that’s because capturing people would be faster. While other people are against it since this will push the bad guys away. Well, they have a point because the villains will just need to behave when passing by the CCTVs.

However, when secret surveillance cameras are also installed in public spaces, you won’t know when you’re being captured. That’s because they’re hidden so will you still find the so-called blind spots only to do bad things? Well, you can never guess where these devices are located, thus, let’s find out more about these tiny recorders.

Public Surveillance

An authorized person or organization is allowed to use spy cams for specific purposes. It has to be legal, which means that they have a permit for this task. Why does it have to be done secretly?

They’re trying to obtain information about a particular individual, place, or event without others noticing it. For example, if they’re monitoring the movement of a convict, then he will avoid the CCTVs. In this case, you can’t catch him, that’s why it’s better to do this quietly so people will be comfortable as well.

Anyway, the authorities usually carry such orders from their superiors. If they will use your property for such operations, then they need to ask for your consent. But if someone at home installed one without your permission, maybe there’s a reason, though recording it illegally can’t be used in trial courts.